Insurance options for small business owners encompass a crucial aspect of financial planning and risk management. From understanding different types of insurance products to customizing plans tailored to specific needs, the choices made can significantly impact the success and sustainability of a small business. Let’s delve into the intricate world of insurance options for small business owners and explore the key considerations that can shape these decisions.

Types of Insurance Options

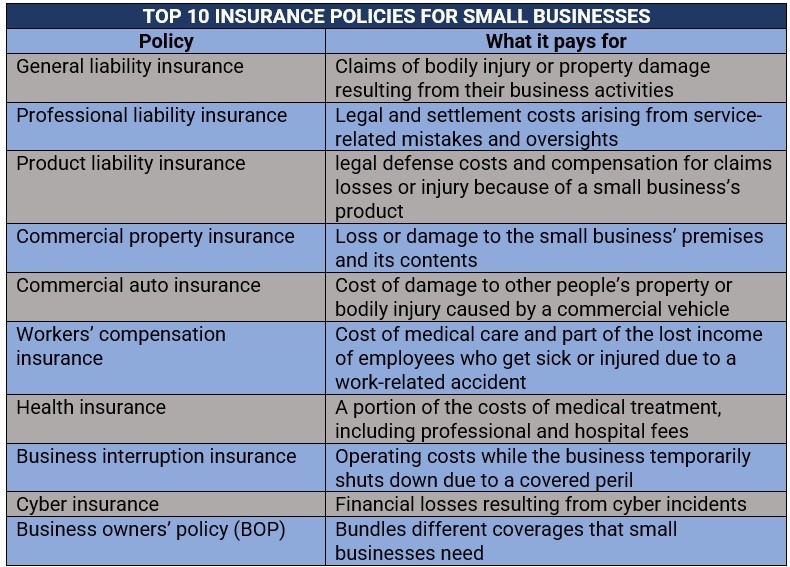

Insurance is essential for small business owners to protect their assets and mitigate risks. There are several types of insurance products available, each offering different coverage options. Some common types of insurance for small businesses include:

1. General Liability Insurance

General liability insurance provides coverage for legal costs and damages if a customer or third party sues your business for bodily injury, property damage, or advertising injury.

2. Property Insurance, Insurance options for small business owners

Property insurance protects your business assets, including buildings, equipment, inventory, and furniture, against damage or theft.

3. Workers’ Compensation Insurance

Workers’ compensation insurance covers medical expenses and lost wages for employees injured on the job. It is mandatory in most states for businesses with employees.

4. Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, protects your business against claims of negligence or inadequate work.

Considerations for Small Business Owners

When choosing insurance options for your small business, several factors need to be considered:

- The size and nature of your business

- The industry you operate in

- The level of risk associated with your business operations

Customizing Insurance Plans

Designing a customized insurance plan for your small business involves assessing your specific needs and risks. Consider factors such as:

- Your industry’s unique risks

- Your business’s location

- Your revenue and budget constraints

Insurance Providers and Policies

There are many insurance providers that cater to small businesses, offering a variety of policies tailored to different industries. When comparing quotes and coverage details, consider:

- The reputation and financial stability of the insurance company

- The extent of coverage provided by the policy

- The cost of premiums and deductibles

Final Wrap-Up

Navigating the realm of insurance options for small business owners requires careful thought and strategic planning. By weighing the types of insurance available, considering individual business needs, and staying informed about regulations, small business owners can safeguard their ventures against unexpected challenges. Remember, the right insurance coverage can be a crucial asset in ensuring the long-term prosperity of your business.

Questions Often Asked: Insurance Options For Small Business Owners

What are some lesser-known insurance options that small business owners should consider?

While general liability and property insurance are common, small business owners should also explore cyber liability insurance to protect against data breaches and business interruption insurance to cover revenue loss during unexpected disruptions.

How can the nature of a small business impact the choice of insurance options?

The nature of a business, such as its industry, size, and operational risks, can influence the type and extent of insurance coverage needed. For instance, a construction company may require more robust liability coverage compared to a consulting firm.