Personal insurance meaning sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with formal and friendly language style and brimming with originality from the outset.

Personal insurance is a crucial aspect of financial planning, providing individuals with protection and peace of mind in the face of unforeseen events. From health to life, auto to home insurance, the world of personal insurance is vast and varied, catering to different needs and circumstances. Let’s delve deeper into the realm of personal insurance to uncover its significance and benefits in safeguarding individuals and their assets.

Definition of Personal Insurance: Personal Insurance Meaning

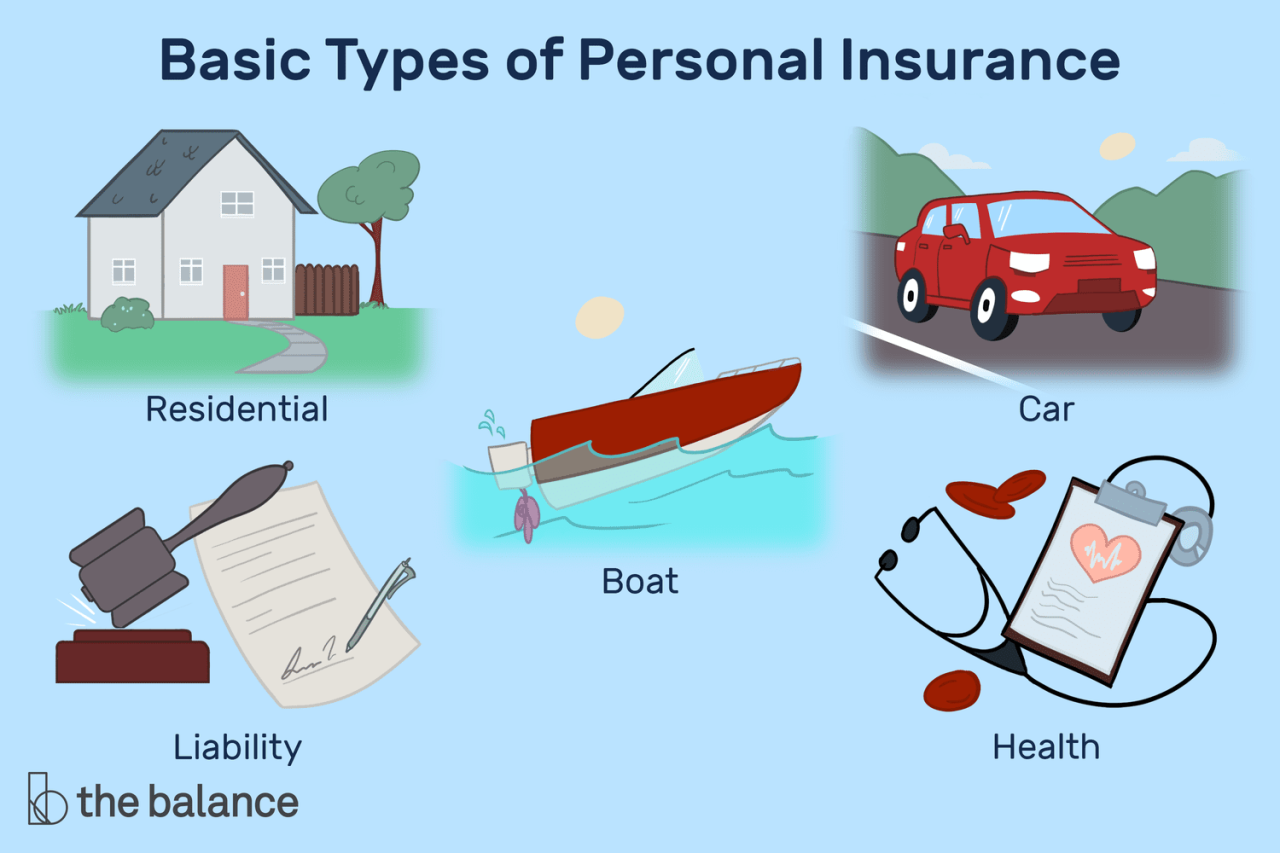

Personal insurance refers to a type of insurance coverage that provides financial protection to individuals against unforeseen events or risks. It serves as a safety net to help mitigate the financial impact of accidents, illnesses, or other unexpected circumstances. Examples of common types of personal insurance include health insurance, life insurance, auto insurance, home insurance, and disability insurance. Personal insurance is essential for individuals to safeguard their well-being and assets in times of need.

Types of Personal Insurance

- Health Insurance: Covers medical expenses and treatments for illnesses or injuries.

- Life Insurance: Provides financial support to beneficiaries in case of the policyholder’s death.

- Auto Insurance: Offers protection against damages or theft of vehicles.

- Home Insurance: Protects homes and belongings from damages or losses due to unforeseen events like fire, theft, or natural disasters.

Each type of personal insurance offers different coverage and benefits tailored to specific needs and circumstances. For example, health insurance can help cover medical bills, while life insurance ensures financial security for loved ones after the policyholder’s passing.

Benefits of Personal Insurance

Personal insurance provides numerous advantages, including financial security, peace of mind, and protection against unexpected events. It can safeguard individuals and their families from significant financial burdens in times of crisis. For instance, health insurance can cover expensive medical treatments, while auto insurance can help repair or replace a damaged vehicle after an accident.

Factors to Consider When Choosing Personal Insurance, Personal insurance meaning

- Coverage Needs: Assess the types of risks you need protection against and choose insurance policies accordingly.

- Cost and Affordability: Consider premiums, deductibles, and coverage limits to find a policy that fits your budget.

- Personal Circumstances: Factors such as age, health status, occupation, and lifestyle can influence the type and amount of insurance coverage needed.

It is essential to evaluate different insurance options, compare quotes, and review policy details to make an informed decision that meets your specific needs and preferences.

Final Conclusion

As we conclude this exploration of personal insurance meaning, it becomes evident that this financial tool serves as a shield against life’s uncertainties, offering security and stability to individuals and their loved ones. By understanding the types, benefits, and factors involved in choosing personal insurance, one can make informed decisions to protect what matters most.

Popular Questions

What does personal insurance mean?

Personal insurance refers to a type of insurance that provides coverage for individuals against various risks, such as health issues, accidents, property damage, or loss of income.

Why is personal insurance important?

Personal insurance is essential as it offers financial protection and security to individuals and their assets in times of need, ensuring peace of mind and stability.

How do personal circumstances influence insurance choices?

Factors like age, health status, lifestyle, and financial situation play a significant role in determining the type and amount of personal insurance coverage that is most suitable for an individual.